BWPT

You will likely

find these contracting trendline to be very important. Elliott Wave

practitioners know the significance of this chart by looking at the possible wedge formation.

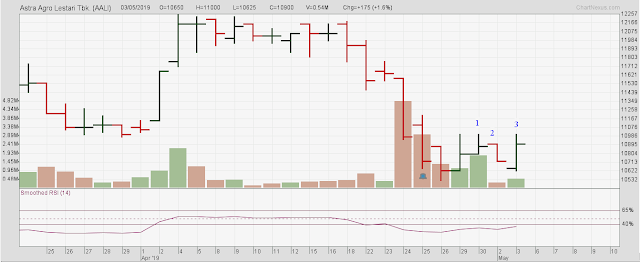

AALI

The expected test

of supply came in bar 2 after we saw supply entered in bar 1. Bar 3 suggests

that the test was successful. I expect to see an increased in volume when the

market exceeds the top of bar 1 to confirm that the buying from May 25 is

genuine.

Unsurprisingly,

analysis in BWPT also suggests an important play is coming shortly.

Comments

Post a Comment